what is suta tax california

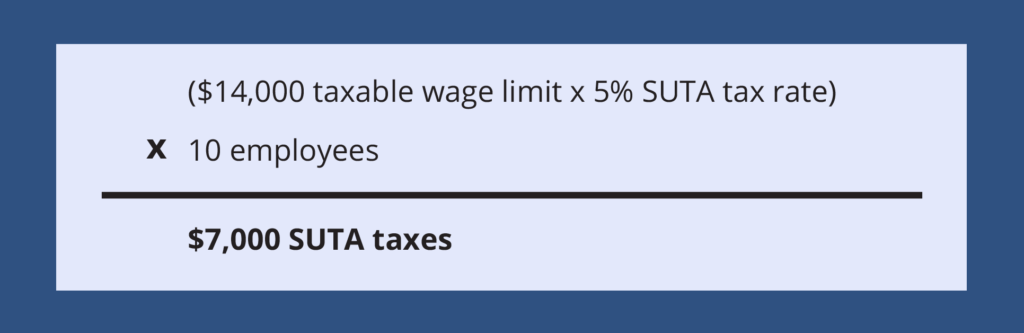

Each state has its own SUTA. The UI rate schedule and amount of taxable wages are determined annually.

The True Cost Of Hiring An Employee In California Hiring True Cost California

The 2020 California employer SUI tax rates continue to range from 15 to 62.

. Assume that your company receives a good assessment and your. California employers fund regular Unemployment Insurance UI benefits through contributions to the states UI Trust Fund on behalf of each employee. UI is paid by the employer.

The SUI taxable wage base for 2020 remains at 7000 per employee. SUTA State Unemployment Tax Act dumping one of the biggest issues facing the Unemployment Insurance UI program is a tax evasion scheme where shell companies are formed and creatively manipulated to obtain low UI tax rates. The new-employer tax rate will also remain stable at 340.

It is often wrongly called Unemployment Insurance or SUI. The taxable wage limit is 145600 for each employee per calendar year. Tax-rated employers pay a percentage on the first 7000 in wages paid to each employee in a calendar year.

The maximum to withhold for each employee is 160160. Transmittal of Wage and Tax Statements Form W-3 1. The states SUTA wage base is 7000 per.

For Wages Employers Paid in 2021. It probably means you have to start making quarterly state unemployment tax SUTA payments to your state. The term SUTA is often used to refer to.

5 of 7000 350. The new employer SUI tax rate remains at 34 for 2020. Californias unemployment tax rates and unemployment-taxable wage base are to be unchanged for 2021 a spokesman for the state Employment Development Department said.

See Determining Unemployment Tax Coverage. 52 rows Most states send employers a new SUTA tax rate each year. In 2019 the taxable wage base for employees in Texas is 9000 and the tax rates range from 36 to 636.

Employers with a positive reserve balance or those with a new employer tax rate will also be subject to the. New employers pay 34 percent 034 for a period of. It is a tax assessed on employers to fund unemployment benefits.

Up to 25 cash back The state UI tax rate for new employers known in some states and federally as the standard beginning tax rate also can change from one year to the next. 2020 SUI tax rates and taxable wage base. The undersigned certify that as of July 1 2021 the internet website of the Franchise.

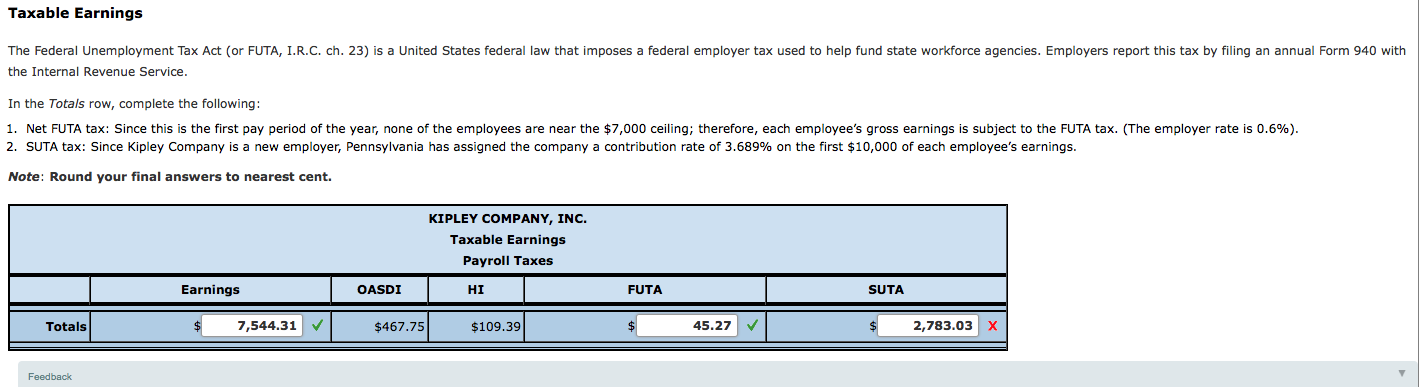

Federal Unemployment Tax Return Form 940 Wage and Tax Statement Form W-2 and. The State Unemployment Tax Act SUTA tax also called SUI state unemployment insurance or reemployment tax is a type of payroll tax that employers must pay to the state. This discounted FUTA rate can be.

Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses pay 34. Generally states have a range of unemployment tax rates for established employers. Employers in California are subject to a SUTA rate between 15 and 62 and new non-construction businesses.

SUTA dumping is also referred to as state unemployment tax avoidance and tax rate manipulation. California Franchise Tax Board Certification date July 1 2021 Contact Accessible Technology Program. The SDI withholding rate for 2022 is 11 percent.

California uses the Dynamex ABC Test to determine whether a worker is an employee for purposes of unemployment tax coverage. Heres what that means for your business. When a low rate is obtained.

All UI taxes for 2022 have been paid in full by January 31 2023. 52 rows SUTA Tax Rates and Wage Base Limit.

Nanny Payroll Part 3 Unemployment Taxes

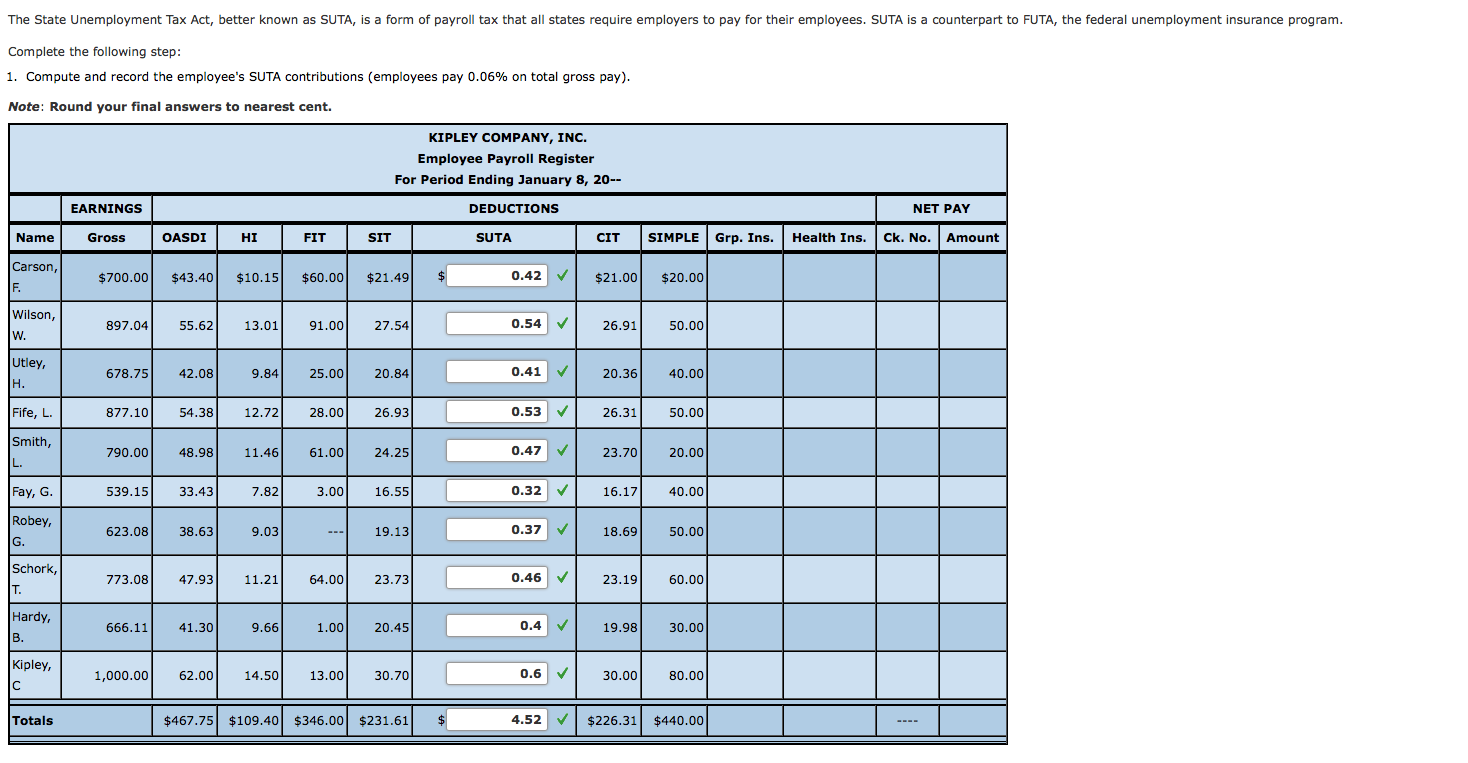

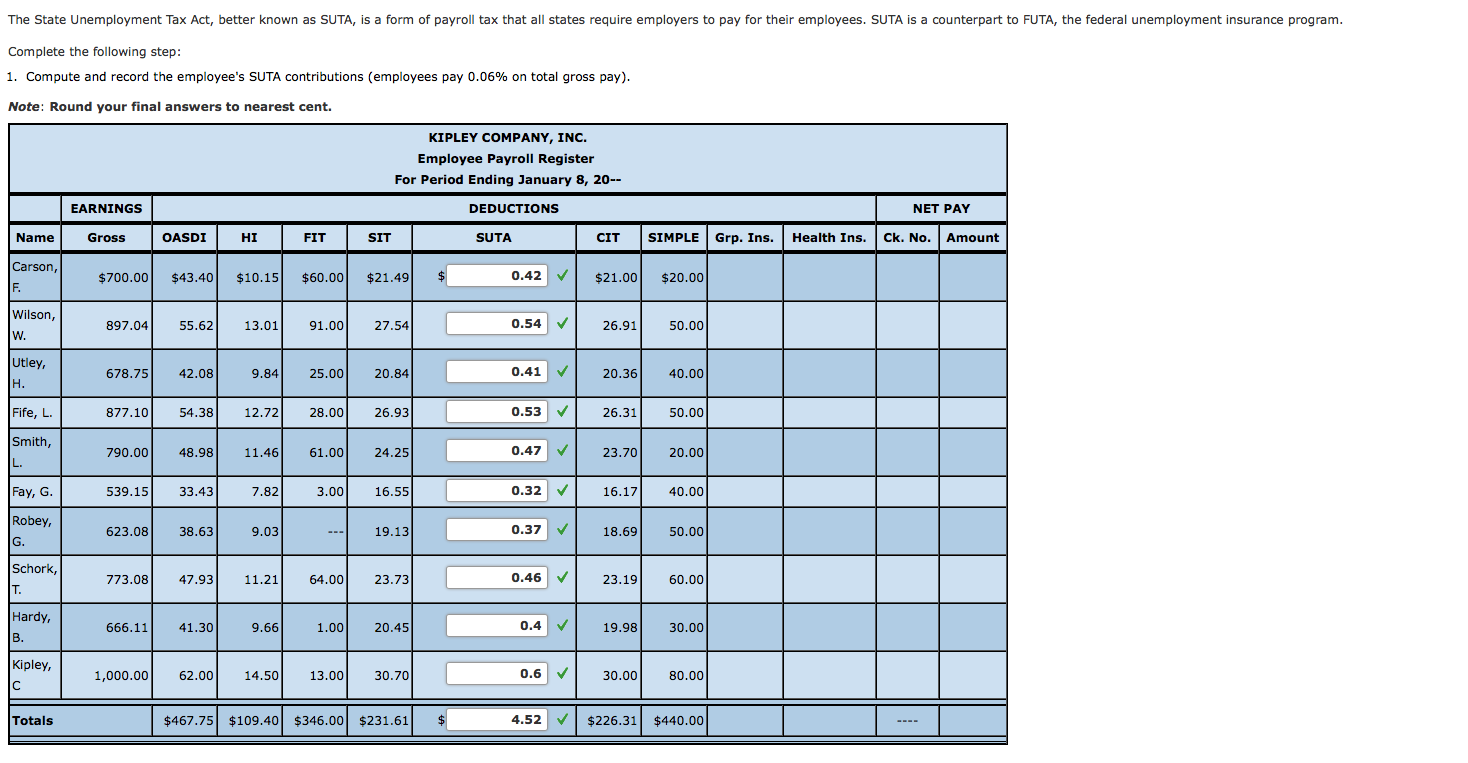

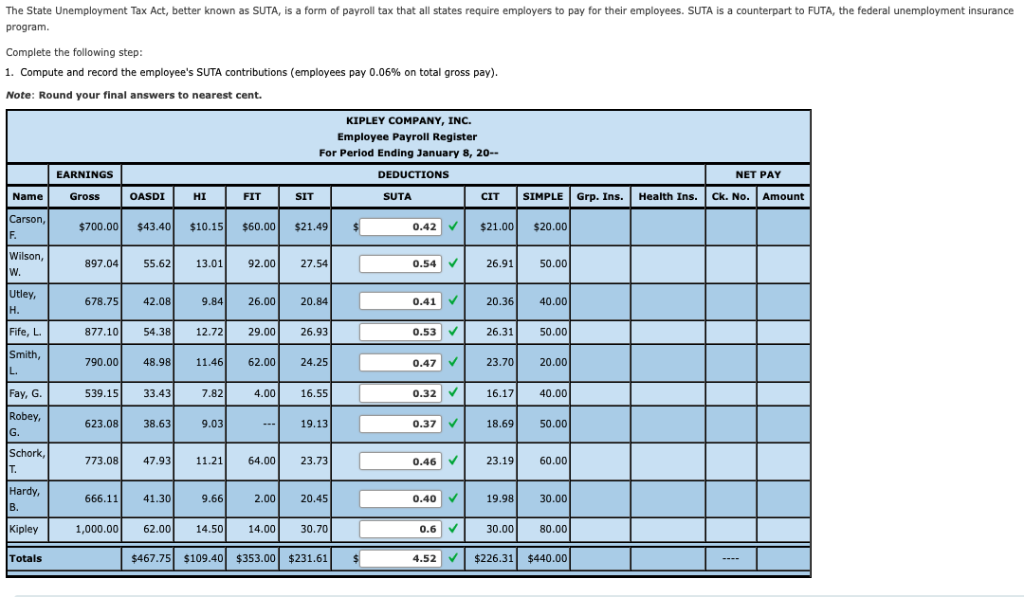

Solved The State Unemployment Tax Act Better Known As Suta Chegg Com

Breaking Down The Federal Unemployment Tax Act What Is It

1099 Etc Voted Best In 1099 W 2 Compliance And 2 In Payroll In Cpa Practice Advisor 2014 Reader Poll Welcome To 1099 Payroll Taxes Payroll Software Payroll

Many Employers Face Higher State Unemployment Insurance Tax Costs Due To Covid 19

Sui Sit Employment Taxes Explained Emptech Com

What Is Sui State Unemployment Insurance Tax Ask Gusto

2022 Federal Payroll Tax Rates Abacus Payroll

State Unemployment Tax Ballotpedia

How To Reduce Your Clients Suta Tax Rate In 2014 Cpa Practice Advisor

What S The Cost Of Unemployment Insurance To The Employer

Ezpaycheck Payroll Software Futa And Suta

Ultimate Guide To Sui And State Unemployment Tax Attendancebot

Futa Tax Overview How It Works How To Calculate

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

Solved The State Unemployment Tax Act Better Known As Suta Chegg Com

Solved The State Unemployment Tax Act Better Known As Suta Chegg Com